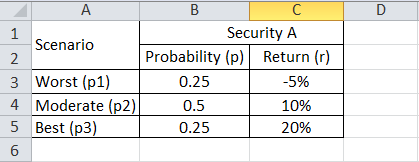

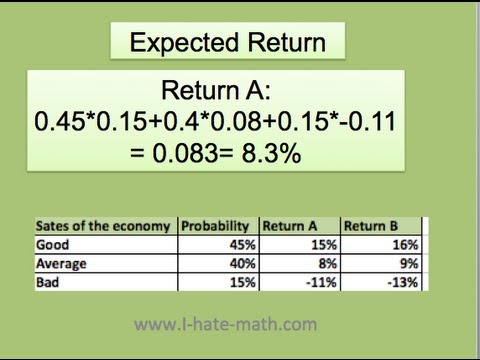

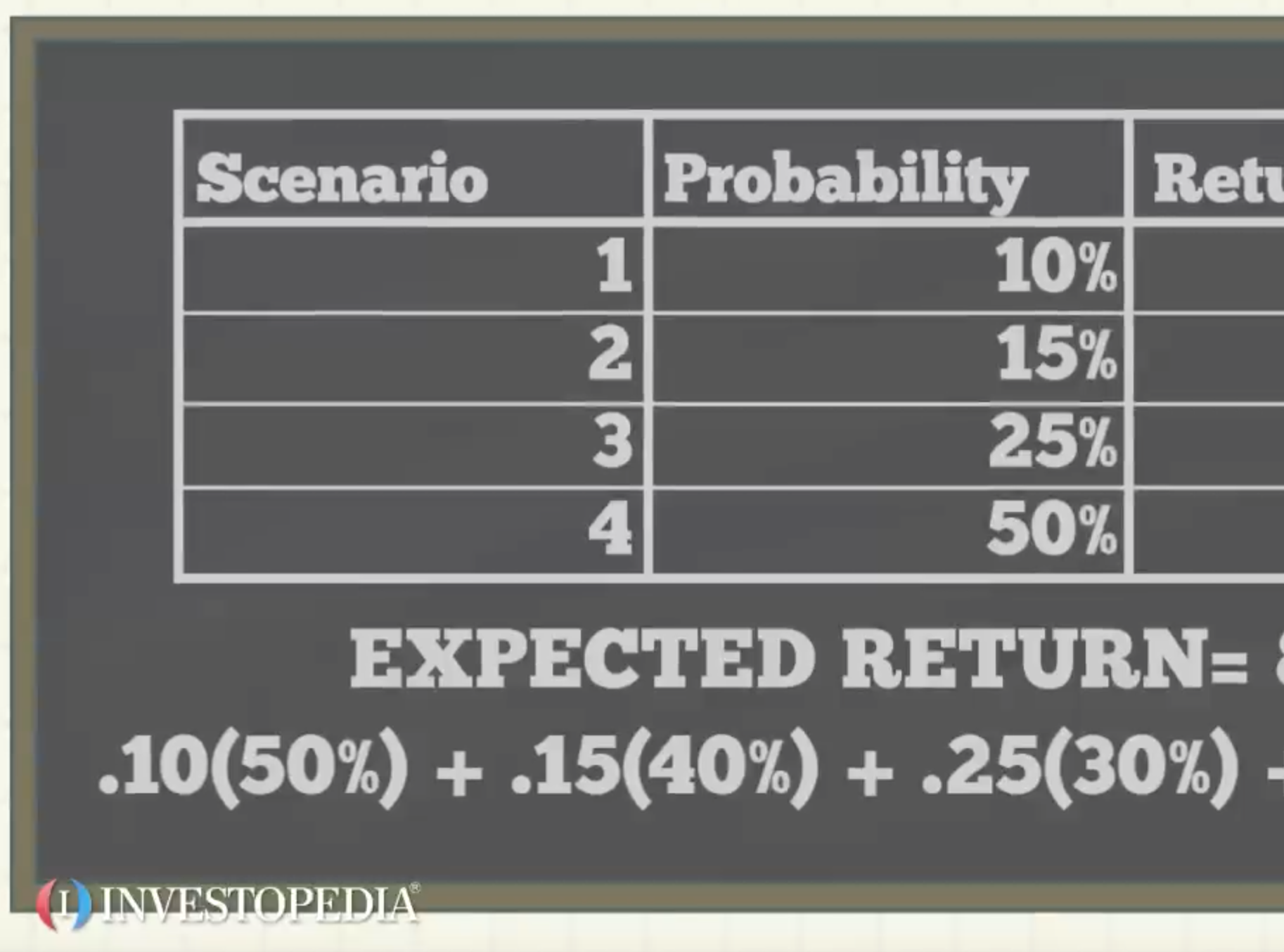

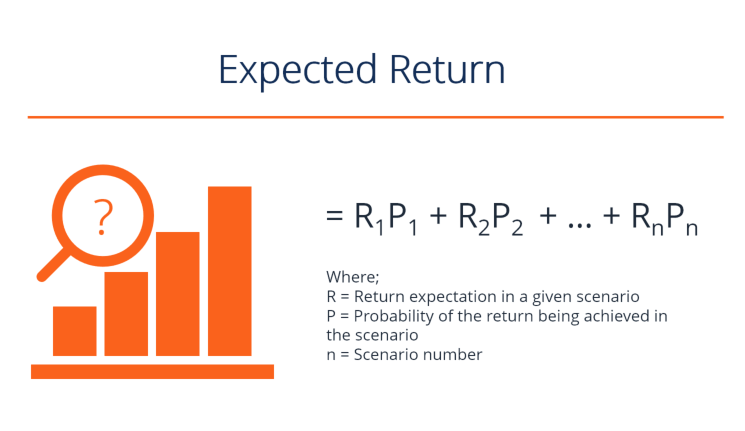

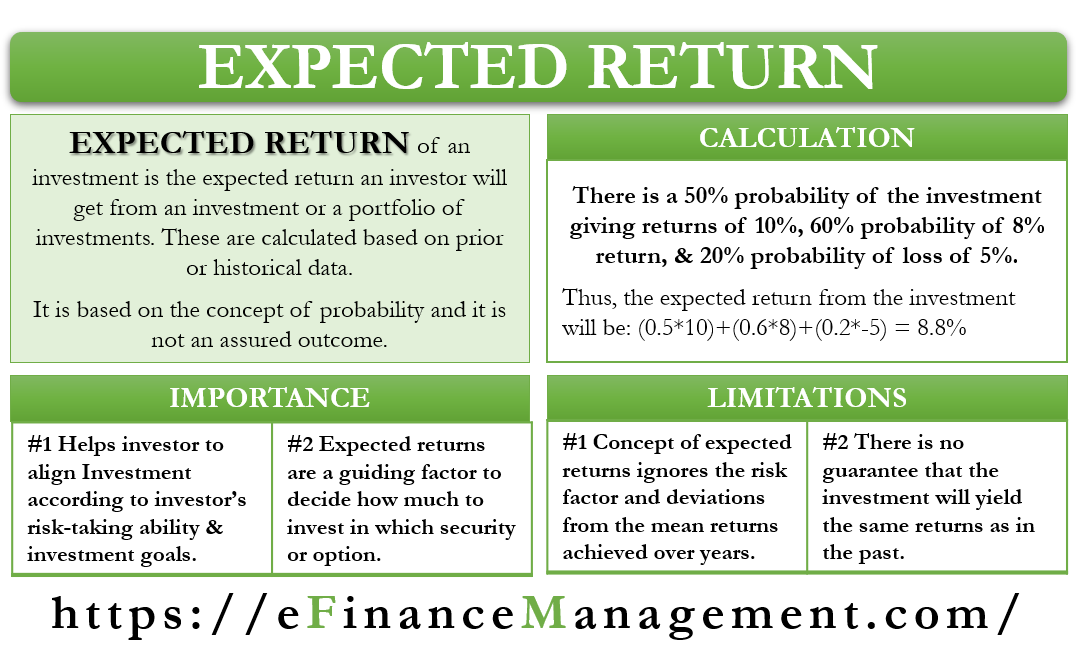

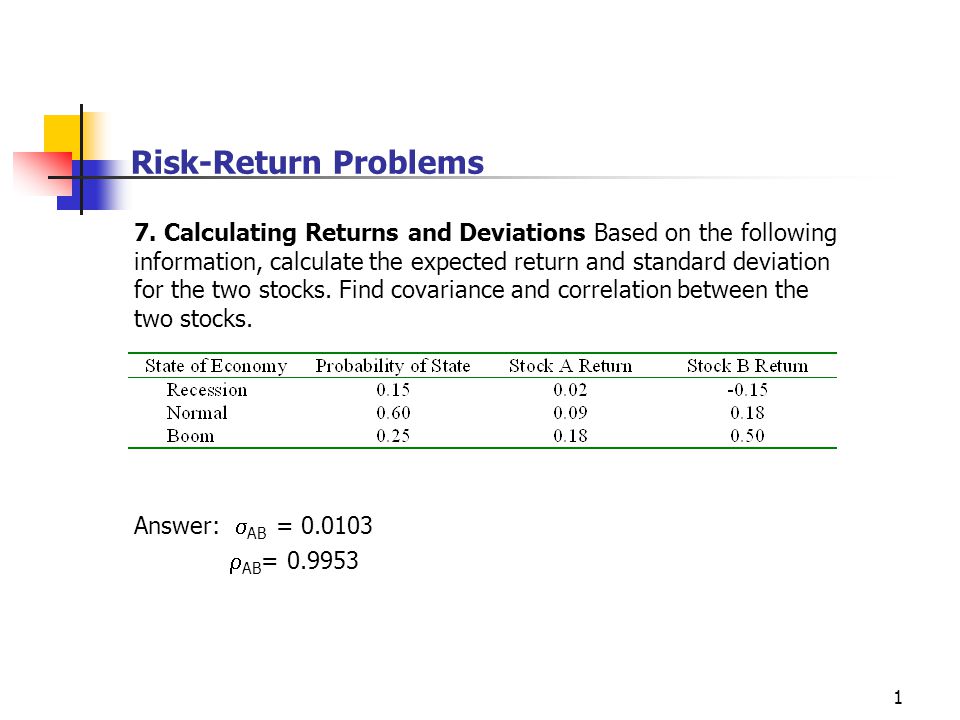

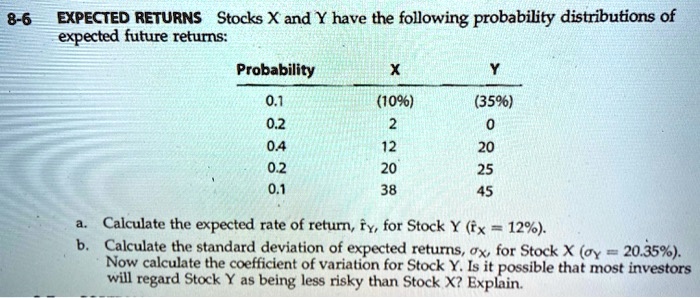

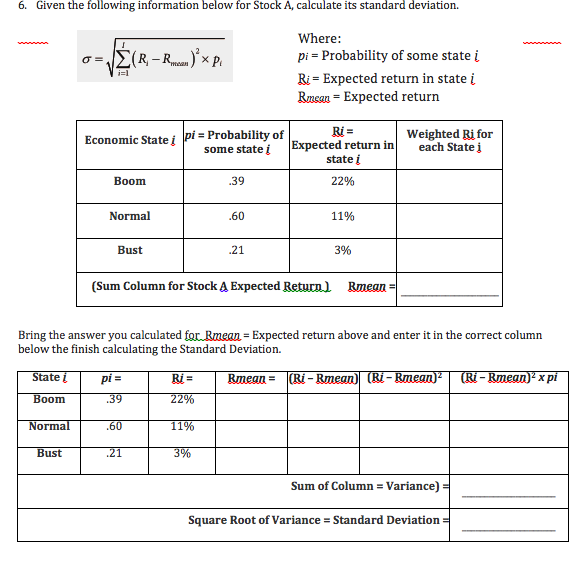

Calculate the return and standard deviation for the following stock, in an economy with five possible states. If a Boom (Probability=25%) economy occurs, then the expected return is 50%. If a Good (

Risk-Return Problems 7. Calculating Returns and Deviations Based on the following information, calculate the expected return and standard deviation for. - ppt video online download

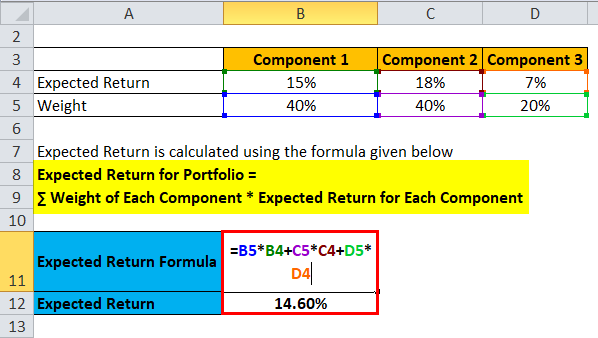

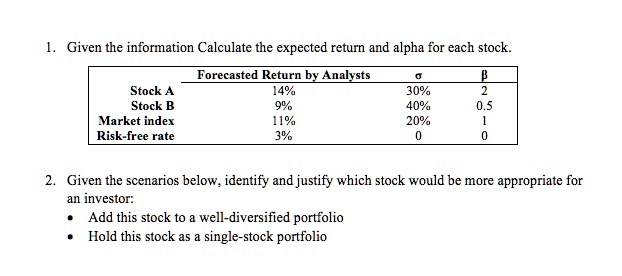

SOLVED: 1. Given the information Calculate the expected return and alpha for each stock Forecasted Return by Analysts 14% 9% 11% 3% a 30% 40% 20% 0 B 2 0.5 1 0

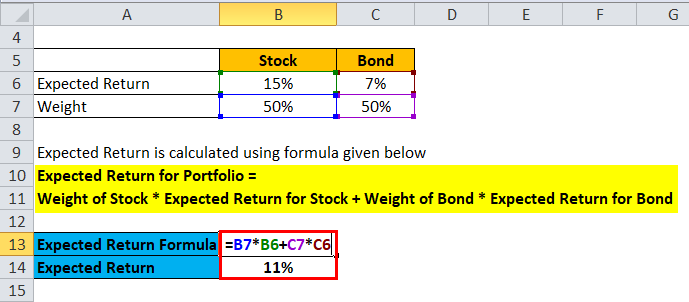

:max_bytes(150000):strip_icc()/ExpectedReturn-4196761-Final-25b2aa6c16ce4a89a778a1e55302136b.jpg)

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)